admkorocha.ru Market

Market

New Ico Cryptocurrency

An Initial Coin Offering (ICO) is a fundraising mechanism in the cryptocurrency industry, akin to an Initial Public Offering (IPO) in the traditional financial. Initial Coin Offerings (ICOs) are a relatively new way to fund start-ups and projects. Similar to an IPO, an ICO is a way for a start-up or an established. Looking for the best crypto ICOs? Use our ICO calender to discover & keep track of the hottest new projects. ICO Drops contains a complete list of all ICOs and IEOs of crypto projects ICO stats · VC · Points Farming · All projects · Active. Upcoming. Ended · ICO. You can do this through cryptocurrency exchanges like Coinbase or Binance. Transfer funds to your digital wallet: Once you have purchased cryptocurrency, you. An initial coin offering (ICO) or initial currency offering is a type of funding using cryptocurrencies. It is often a form of crowdfunding. Latest ICO ; $UCOIN U-topia ($UCOIN). IDO, Spores Network ; $BOON Baboon ($BOON). IDO, On Website ; $CPRN Capitron Exchange ($CPRN). ICO, On Website ; $SPNDA Solo. Initial coin offerings, also referred to as ICOs or token sales, are a way to fund cryptocurrency projects. An initial coin offering is used by startups to. Investments in initial coin offerings (ICOs) have dropped by nearly 95% according to data from cryptocurrency analytics firm, Coinschedule. In March , ICOs. An Initial Coin Offering (ICO) is a fundraising mechanism in the cryptocurrency industry, akin to an Initial Public Offering (IPO) in the traditional financial. Initial Coin Offerings (ICOs) are a relatively new way to fund start-ups and projects. Similar to an IPO, an ICO is a way for a start-up or an established. Looking for the best crypto ICOs? Use our ICO calender to discover & keep track of the hottest new projects. ICO Drops contains a complete list of all ICOs and IEOs of crypto projects ICO stats · VC · Points Farming · All projects · Active. Upcoming. Ended · ICO. You can do this through cryptocurrency exchanges like Coinbase or Binance. Transfer funds to your digital wallet: Once you have purchased cryptocurrency, you. An initial coin offering (ICO) or initial currency offering is a type of funding using cryptocurrencies. It is often a form of crowdfunding. Latest ICO ; $UCOIN U-topia ($UCOIN). IDO, Spores Network ; $BOON Baboon ($BOON). IDO, On Website ; $CPRN Capitron Exchange ($CPRN). ICO, On Website ; $SPNDA Solo. Initial coin offerings, also referred to as ICOs or token sales, are a way to fund cryptocurrency projects. An initial coin offering is used by startups to. Investments in initial coin offerings (ICOs) have dropped by nearly 95% according to data from cryptocurrency analytics firm, Coinschedule. In March , ICOs.

ICOs are initial coin offerings and bring new crypto tokens to market. Here's how they work, and what investors should know before ICO investing. An initial coin offering (ICO) is a type of capital-raising activity in the cryptocurrency and blockchain environment. The ICO can be viewed as an initial. Top ICOs & Upcoming ICO Calendar ; Base Dawgz. DAWGZ Base Dawgz ; Pepe Unchained. PEPU Pepe Unchained ; Crypto All Stars. STARS Crypto All Stars ; Arkenstone. ARKN. Pepe Unchained – New Ethereum L2 meme coin conducting the best ICO right now. Crypto All-Stars – A single crypto platform for staking the world's best meme. The Best ICO List to Discover Emerging Cryptocurrencies · Crypto All Stars · Pepe Unchained · The Meme Games · VAUL3 Hot · PlayDoge · Poodlana · Shiba Shootout. Discover upcoming ICOs on IcoHolder, explore Initial Coin Offerings, project insights, funding goals, and market trends for informed cryptocurrency. Initial coin offerings (ICO) provide access to brand-new crypto projects, usually at a discounted price for early investors. In this beginner's guide. Check out upcoming ICOs, IEOs, IDOs, and STOs that will be launching soon ; CoinPays logo · CoinPays (CPY). CoinPays (CPY) on Spores Launchpad CoinPays (CPY) on. An initial coin offering (ICO) is an event where a company sells a new cryptocurrency to raise money. Investors receive cryptocurrency in exchange for their. IBA Global Insight February/March - Regulators are grappling with initial coin offerings (ICOs), the latest cryptocurrency trend. China and South Korea. List of upcoming token generation events and token sales. Information about the date of the event, initial capitalization, total raise. An initial coin offering, or ICO, is a controversial fundraising method for launching blockchain and cryptocurrency networks that involves the sale and. Through ICO trading platforms, investors receive unique cryptocurrency “tokens” in exchange for their monetary investment in the business. It is a means of. ICO stands for an Initial Coin Offering. It is also regarded as an alternative form of crowdfunding for releasing a new crypto unit. Startups use ICOs as a. Through ICO trading platforms, investors receive unique cryptocurrency “tokens” in exchange for their monetary investment in the business. It is a means of. r/CryptocurrencyICO: r/Cryptocurrency & ICO is a hub for sharing crypto news & discussing new innovative ICO quality projects with proven utility. An initial coin offering (ICO) is a type of capital-raising activity in the cryptocurrency and blockchain environment. Initial coin offerings (ICOs) are a new method of raising capital for early-stage ventures. A critical milestone for every cryptocurrency therefore is the. An initial coin offering (ICO) or initial currency offering is a type of funding using cryptocurrencies. It is often a form of crowdfunding. Reverse ICOs can be used to generate funds for the company, to facilitate decentralizing through a new crypto token, or to expand into the blockchain and.

Best Places To Retire Outside Of Us

Let's explore why US citizens decide to retire in foreign countries and what the best destinations are for their retirement. With its amazing culture, thriving social life, and local markets, Thailand is one of the best places for expats to live. The cost of medical assistance in. 2. Portugal Portugal is another country ranked highly by both Live and Invest Overseas and International Living. Like Ecuador, Portugal offers a variety of. The Complete Rankings Of The Overseas Retirement Index · 1. Valencia, Spain, A · 2. Braga, Portugal, A · 3. Mazatlán, Mexico, A- · 4. Crete, Greece, A- · 5. As the cost of everyday life in the United States continues to rise, more and more Americans are considering the possibility of spending their golden years. Find helpful customer reviews and review ratings for Best Places to Retire: [Overseas] - Discover the 10 Best Places to Retire Where Every Day Feels Like. Expat retirees find a treasure trove of benefits in Portugal. The welcoming locals, picturesque landscapes, and vibrant culture make it enticing. Warm, tropical weather, a low cost of living, and proximity to the U.S. make Mexico a top destination for retired expats from all over the world. Whether you. With its amazing culture, thriving social life, and local markets, Thailand is one of the best places for expats to live. The cost of medical assistance in. Let's explore why US citizens decide to retire in foreign countries and what the best destinations are for their retirement. With its amazing culture, thriving social life, and local markets, Thailand is one of the best places for expats to live. The cost of medical assistance in. 2. Portugal Portugal is another country ranked highly by both Live and Invest Overseas and International Living. Like Ecuador, Portugal offers a variety of. The Complete Rankings Of The Overseas Retirement Index · 1. Valencia, Spain, A · 2. Braga, Portugal, A · 3. Mazatlán, Mexico, A- · 4. Crete, Greece, A- · 5. As the cost of everyday life in the United States continues to rise, more and more Americans are considering the possibility of spending their golden years. Find helpful customer reviews and review ratings for Best Places to Retire: [Overseas] - Discover the 10 Best Places to Retire Where Every Day Feels Like. Expat retirees find a treasure trove of benefits in Portugal. The welcoming locals, picturesque landscapes, and vibrant culture make it enticing. Warm, tropical weather, a low cost of living, and proximity to the U.S. make Mexico a top destination for retired expats from all over the world. Whether you. With its amazing culture, thriving social life, and local markets, Thailand is one of the best places for expats to live. The cost of medical assistance in.

10 best places to retire outside the U.S.. By stewart. Located between Brazil and Argentina, Uruguay is the second smallest country in South America. With its low cost of living, Kansas in general rates as one of our 10 best states for retirement. And the capital city is particularly affordable. The median. Top 27 best countries to retire for American expats · 1. Norway — best of the best · 2. Switzerland — high quality of life at the Alps' footsteps · 3. Iceland —. Cyprus is one of the best countries in which to retire. It's a small country of mythical legend, with Greek poets championing the island as the birthplace of. Let's explore some of the best options for retiring abroad, why each has become a hot spot for retirement, and what to consider about each location. They always say places good to make money are bad for retirement, and vice versa. I'm curious to learn about people's experiences retiring in more affordable. However, generally, Australia, Thailand, Fiji are better countries to retire as they offer cost effective life style and medical facilities. The. They always say places good to make money are bad for retirement, and vice versa. I'm curious to learn about people's experiences retiring in more affordable. 4 Best Places in Panama to Experience. porto_portugal_facade_riviera. Best About Us · Contact Us. © Live Like a Local Abroad. All Rights Reserved. 7. Do I need any vaccinations? It depends where you're going. Some countries require you to have specific vaccinations before you'll be permitted to enter. The. Cyprus is one of the best countries in which to retire. It's a small country of mythical legend, with Greek poets championing the island as the birthplace of. As the cost of everyday life in the United States continues to rise, more and more Americans are considering the possibility of spending their golden years. Switzerland. #1 in Comfortable Retirement Rankings · Portugal. #2 in Comfortable Retirement Rankings · Australia. #3 in Comfortable Retirement Rankings · New. Retiring abroad is a dream for many, and with the right destination, it can turn into a delightful reality. Portugal, Spain, and Thailand have emerged as the. Live, Retire and Invest Overseas. Articles, news, classifieds, information on retirement, and living abroad from International Living. Norway is rated one of the top overall countries to retire to, due to its excellent healthcare, strong economy, beautiful scenery, and focus on work-life. The Annual Global Retirement Index is the most comprehensive and in-depth survey of its kind, helping aspiring expats sift through the wealth of. Expat retirees find a treasure trove of benefits in Portugal. The welcoming locals, picturesque landscapes, and vibrant culture make it enticing. Costa Rica was one of the first countries to offer a benefits package aimed at expat retirees. Here you'll find sandy beaches, good healthcare, rich. I'm in Alicante, and I think it would be a great place for you. Castellano is not much different from latin America spanish. I'm doing just fine.

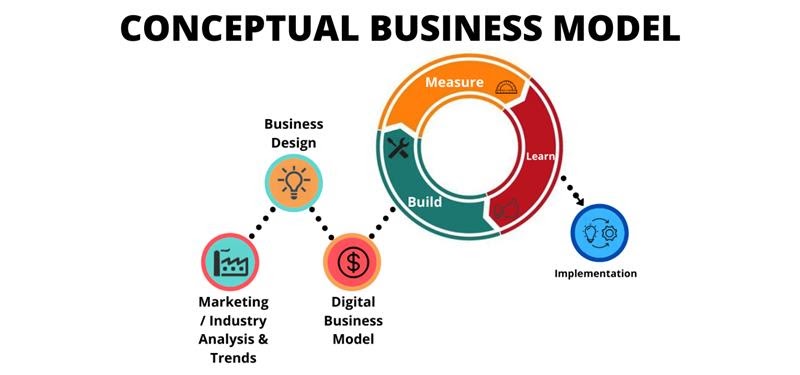

Good Business Model Examples

Well-known examples of platform businesses include Facebook, GitHub, Uber and Airbnb. Online personal styling subscription service Stitch Fix is another great. This model of social enterprise (SE) sells business support services directly to the entrepreneurs in its target population. In other words, this type of SE. 10 Business Models That Will Inspire You · 1. Airbnb · 2. Alibaba · 3. Hilti · 4. IKEA · 5. Tesla · 6. Wikipedia · 7. Zara · 8. Local Motors. Common examples of business model types · Subscription model · On-demand model · Crowd-sourcing model · Online model · Freemium model · Retail model · Bundling model. The first of these business model canvas examples is for an automobile company. The company that is portrayed in this example is a company with a focus on. Types of Business Models · 1. Retailer Model · 2. Manufacturer Model · 3. Fee For service Model · 4. Subscription Model · 5. Bundling Model · 6. Product as well as. For example, Ryanair's business model creates several virtuous cycles that maximize its profits through increasingly low costs and prices. (See the exhibit “. Typically, startups operating under this business model don't sell their own goods—however, Amazon is an example of a marketplace that also produces and sells. The perfect business model: real-world examples and success stories · Airbnb: The peer-to-peer rental marketplace (sharing economy) · Zalando: The online fashion. Well-known examples of platform businesses include Facebook, GitHub, Uber and Airbnb. Online personal styling subscription service Stitch Fix is another great. This model of social enterprise (SE) sells business support services directly to the entrepreneurs in its target population. In other words, this type of SE. 10 Business Models That Will Inspire You · 1. Airbnb · 2. Alibaba · 3. Hilti · 4. IKEA · 5. Tesla · 6. Wikipedia · 7. Zara · 8. Local Motors. Common examples of business model types · Subscription model · On-demand model · Crowd-sourcing model · Online model · Freemium model · Retail model · Bundling model. The first of these business model canvas examples is for an automobile company. The company that is portrayed in this example is a company with a focus on. Types of Business Models · 1. Retailer Model · 2. Manufacturer Model · 3. Fee For service Model · 4. Subscription Model · 5. Bundling Model · 6. Product as well as. For example, Ryanair's business model creates several virtuous cycles that maximize its profits through increasingly low costs and prices. (See the exhibit “. Typically, startups operating under this business model don't sell their own goods—however, Amazon is an example of a marketplace that also produces and sells. The perfect business model: real-world examples and success stories · Airbnb: The peer-to-peer rental marketplace (sharing economy) · Zalando: The online fashion.

Targeting and focusing only the large clients, enterprise business model is all based on getting big deals. It is built on complex sales with a good few. Companies pursuing the Open Business model try to leave profitable niches Show practical examples or models of the desired behavior for clear guidance. business model pattern, as well as exemplary firms applying the pattern. Examples: Zara Standard Oil Company JCDecaux Ford Amazon Store · Card image cap. Examples Of Successful Startup Business Models To Consider · 1. Product/Service Model (Hook & Bait) · 2. Reseller (Magic) · 3. Ad-Based Model · 4. Subscription-. A business model outlines how a company will operate, its target market, products, required investments, and revenue generation. Dive into the entire. Examples · Auction business model · All-in-one business model · Chemical leasing · Low-cost carrier business model · Loyalty business models · Monopolistic business. We hope that these will serve as a startup business plan template and make it easier to write your own. At a minimum, these will provide some great business. Starbucks, Domino's, Subway, McDonald's, Dunkin Donuts, Hertz, and the UPS Store are all common examples of the franchise model. 8. The Aggregator Business. This business model makes the customer purchasing experience simpler by packaging related products together. iPod and iTunes is a good example. 3 –. 1. Freemium Business Model (Freemium = Free + Premium). The freemium business model allows users to utilize basic features of a software, game. Razor and blade model; Crowdfunding; Open source model; No frills model (discount or budget model). 17 Common Business Model Examples · 1. Advertising · 2. Affiliate · 3. Brokerage · 4. Concierge/customization · 5. Crowdsourcing · 6. Disintermediation · 7. Three Examples of Successful Business Model Innovation · Amazon's Subscription Model Grows Customer Lifetime Value · Airbnb's Value Chain Grows the Total. 15 Types of Business Models with Examples · grocery stores, restaurants, and coffee shops. · Shopify, Alibaba, PayPal. · Zara, Walmart, Amazon, and Target. · Toyota. A revenue model is the income generating framework that is part of a company's business model. Common revenue models include subscription, licensing and markup. A good example of this business model is an auto retailer offering an annual service membership for maintenance on a newly purchased car. The key advantage is. A lemonade stand can be a great example of your initial approach to a business model canvas. It is likely the most understandable model for one's first. Examples of marketplaces include eBay (a marketplace of buyers and sellers of used goods), Uber (a marketplace of car drivers and car riders), Airbnb (a. The idea is simple: When a consumer buys a product, the business will give the same item to someone else who needs the product. The strategy works well for. List of 18 business models ; 1. Advertising · CBS, The New York Times, YouTube ; 2. Affiliate · admkorocha.ru, admkorocha.ru ; 3. Brokerage.

Whole Foods Credit Card Application

Pros · No annual fee · No Prime membership required · $ Amazon gift card upon approval, with no spending requirements · 3% back at Amazon and Whole Foods Market. I have questions about my job application. Where can I get help? If I have a charge from Whole Foods Market that I don't recognize on my credit card. Apply for Prime Visa from Chase. Earn 5% back at admkorocha.ru, Amazon Fresh, Whole Foods Market, and on Chase Travel purchases, 2% back at gas stations. With Fetch, you can get free gift cards simply for shopping, snapping all your receipts and playing games on your phone! Try our rewards app today. Personal Card Annual Credit. Prepaid Cards. View All Prepaid & Gift on U.S. purchases at Amazon Business, AWS, admkorocha.ru and Whole Foods Market. Now you can use your Whole Foods Market or Amazon Shopping apps to activate your Prime savings and pay at all Whole Foods Market stores. Simply scan the In. 5% back or 3% back at admkorocha.ru, Whole Foods Markets and the participating Amazon stores and sites: You'll earn 5% back with an eligible Prime membership or 3%. card for Prime Day this year. It is a Chase Visa so wide acceptance. No annual fee. No foreign transaction fee. 5% admkorocha.ru 5% Whole Foods. This credit card does not require a Prime membership and still offers 3% back at Amazon and Whole Foods, along with the 2% back at restaurants, gas stations and. Pros · No annual fee · No Prime membership required · $ Amazon gift card upon approval, with no spending requirements · 3% back at Amazon and Whole Foods Market. I have questions about my job application. Where can I get help? If I have a charge from Whole Foods Market that I don't recognize on my credit card. Apply for Prime Visa from Chase. Earn 5% back at admkorocha.ru, Amazon Fresh, Whole Foods Market, and on Chase Travel purchases, 2% back at gas stations. With Fetch, you can get free gift cards simply for shopping, snapping all your receipts and playing games on your phone! Try our rewards app today. Personal Card Annual Credit. Prepaid Cards. View All Prepaid & Gift on U.S. purchases at Amazon Business, AWS, admkorocha.ru and Whole Foods Market. Now you can use your Whole Foods Market or Amazon Shopping apps to activate your Prime savings and pay at all Whole Foods Market stores. Simply scan the In. 5% back or 3% back at admkorocha.ru, Whole Foods Markets and the participating Amazon stores and sites: You'll earn 5% back with an eligible Prime membership or 3%. card for Prime Day this year. It is a Chase Visa so wide acceptance. No annual fee. No foreign transaction fee. 5% admkorocha.ru 5% Whole Foods. This credit card does not require a Prime membership and still offers 3% back at Amazon and Whole Foods, along with the 2% back at restaurants, gas stations and.

Apply for Amazon Business Prime Card from American Express to get 5% back at Amazon and AWS or a day interest-free period with eligible prime membership. A penalty APR may apply indefinitely if you miss a payment. Card The Amazon Visa card earns the most rewards when used for Amazon or Whole Foods. Whole Foods, 2% of your money back from restaurants The interest rates of this credit card depend on your credit score at the time of your application. Walgreens, Whole Foods, and other select retailers; Participating transit Autoload links your Clipper card to your credit card, bank account or. The Whole Foods Credit Card is a good credit card for frequent Whole Foods and admkorocha.ru shoppers with good credit or better, particularly Prime members. Whole Foods Market Gift Cards make for the perfect gift. Purchase physical gift cards, instant eGift cards and reload your Whole Foods Market Gift Card. The Whole Foods Market app · Access your Prime discount. · New! Shop for pantry staples. · Browse weekly sales. · Create a shopping list. · Find what you need. · New! Groceries are one of the largest expenses for American households, and as food prices have continued to rise nationally, saving on your grocery purchases. This card earns 5% back at admkorocha.ru, Amazon Fresh and Whole Foods Market with an eligible Prime membership, 5% back on travel booked through Chase. How do I apply for the Prime Visa Card? Visit admkorocha.ru to learn eating venues, people with food-ingredient allergies should not consume these. I have questions about my job application. Where can I get help? If I have a charge from Whole Foods Market that I don't recognize on my credit card. The details of your credit card will specify if your card account earns 5% back or 3% back on purchases made at admkorocha.ru, any Whole Foods Market and the. Get 5% back at admkorocha.ru, Whole Foods Market stores in Canada, grocery stores and restaurants! Apply for your new card using our simple and secure online. The Chase Amazon credit card, Prime Visa, offers rewards to loyal Amazon and Whole Foods customers. Whole Foods Market Careers. Apply Now. Every Ingredient for Your Dream Job. Cash back credit cards from Bank of America allow you to earn cash rewards on all of your purchases. Apply online. Earn 20, bonus points after qualifying purchases, plus a whole lot more The application process for the Citi Rewards+® Card is easy and straightforward. Whole Foods Market Careers. Apply Now. Every Ingredient for Your Dream Job. Apple Card offers up to 3% Daily Cash back on purchases with no fees. Apply with no impact to your credit score to see if you're approved. Terms apply.

Best Way To Invest Hsa

HealthEquity is the best option for individuals who want a robo-advisor service to help them invest their HSA balance. HealthEquity offers three investment. Betterment is the largest independent digital investing advisor and offers a more managed, automated way to invest your HSA money. Betterment combines low. The HSA Invest program. HSA Invest offers you a seamless experience to manage your saving, spending and investing on one website and one app. BenefitWallet has an integrated investment platform, which provides HSA members with a seamless and affordable way to invest and grow their HSA dollars. Yes. At a minimum you could put it in a money market fund through your HSA's broker and be earning ~5% right now. Your HSA is more than just a way to pay for near-term medical expenses. By investing a portion of your HSA balance into various market funds, you can accelerate. To start investing your HSA in mutual funds, simply follow these steps: Sign in to your HSA and set up your investment account by choosing the funds you want to. Investing your HSA dollars may potentially grow your savings and can be an additional way to save for long- term health care needs and your financial goals. That's right. Investing your HSA dollars has many potential tax benefits and can be an additional way to save for long-term health care needs and financial. HealthEquity is the best option for individuals who want a robo-advisor service to help them invest their HSA balance. HealthEquity offers three investment. Betterment is the largest independent digital investing advisor and offers a more managed, automated way to invest your HSA money. Betterment combines low. The HSA Invest program. HSA Invest offers you a seamless experience to manage your saving, spending and investing on one website and one app. BenefitWallet has an integrated investment platform, which provides HSA members with a seamless and affordable way to invest and grow their HSA dollars. Yes. At a minimum you could put it in a money market fund through your HSA's broker and be earning ~5% right now. Your HSA is more than just a way to pay for near-term medical expenses. By investing a portion of your HSA balance into various market funds, you can accelerate. To start investing your HSA in mutual funds, simply follow these steps: Sign in to your HSA and set up your investment account by choosing the funds you want to. Investing your HSA dollars may potentially grow your savings and can be an additional way to save for long- term health care needs and your financial goals. That's right. Investing your HSA dollars has many potential tax benefits and can be an additional way to save for long-term health care needs and financial.

HSA Investment Strategies · Treat your HSA like an investment account. · Max out your investment by making the maximum annual contribution each year (including. Investing your HSA allows you to be better prepared for future healthcare and retirement expenses. Your invested HSA funds grow tax free and remain tax free. Your Optum Bank® health savings account (HSA) is a smart way to pay for Be sure to discuss with your financial advisor whether investing the money in your HSA. For example, one popular option for many is HealthSavings Administrators. This HSA provider lets you invest from your first dollar with no minimum balance. A Health Savings Account (HSA) could be an effective way to help cover your current and future out-of-pocket health care expenses. Use your HSA as an investment vehicle in addition to other tax-advantaged accounts, such as a (k) and individual retirement accounts (IRAs). Contribute the most allowed to your account at the beginning of each year. Even though you have until you file a tax return to make HSA deposits, starting right. Health savings accounts (HSAs) are particularly prized for their triple tax advantages: Contributions are tax-deductible, earnings are tax-free, and. An HSA investment platform provides a convenient way to grow your HSA dollars by investing in a variety of widely recognized mutual funds. computer, or tablet – from the same place you manage your HSA! • Flexible For more information about the three investment methods, see the 'how to' sections. Invest your HSA from day 1! Lively has no minimum balance required to start investing. Manage your invested HSA funds entirely online. You can invest a portion of your Health Savings Account (HSA) in a wide variety of mutual funds to give your account potential to grow over time. Your HSA is more than just a way to pay for near-term medical expenses. By investing a portion of your HSA balance into various market funds, you can accelerate. If your primary goal is to amass savings that can be used for medical expenses both now and in the future, an HSA can be a better option than a Roth IRA or a. Grow the balance in your health savings account by investing a portion of your HSA dollars in our high-quality, low-cost mutual funds. Betterment is one of the largest independent online financial advisors and offers a more managed, automated way to invest your HSA money. Betterment. Opening a Health Savings Account (HSA) can be a great investment in one's personal healthcare and financial future. Owned by the participant (rather than. How will I know how much of the money in my KeyBank HSA is available to be invested in a KIS HSA. If you decide to invest, there are two ways that you can invest a portion of your HSA balance. Automatic transfer or manual transfer. Automatic transfer. HSA is great because it can be invested like a standard retirement account, to grow your savings over time. The more love you put in, the better it gets for.

What Is A Hybrid Annuity

Hybrid annuities are a combination of a fixed annuity and a traditional long term care policy. Your funds grow at a declared interest rate each year. Should you. These “hybrid LTC” policies, also known as asset-based plans, combine the benefits of an annuity with the availability of long-term care benefits should you. A hybrid annuity is a term for retirement income products that allow long-term investors to split their funds between guaranteed rate and non-guaranteed rate. When you require long-term care, hybrid insurance policies allow you to access a portion of your life insurance death benefit or annuity value to cover care. Indexed annuities, also called equity-indexed or fixed-index annuities, are a hybrid. One type of indexed annuity, registered index-linked annuities (RILAs). A hybrid annuity combines the features of a fixed annuity and a variable annuity. Hybrid annuities offer guaranteed lifetime income like a fixed annuity. A hybrid annuity combines the stability of a fixed annuity with the potential for growth offered by a variable annuity. Hybrid Annuity. An industry coined term to describe a fixed indexed annuity that has an optional income rider attached. It enables people to invest in various assets, including stocks and bonds. Although this kind of annuity entails more risk, it also has the potential for more. Hybrid annuities are a combination of a fixed annuity and a traditional long term care policy. Your funds grow at a declared interest rate each year. Should you. These “hybrid LTC” policies, also known as asset-based plans, combine the benefits of an annuity with the availability of long-term care benefits should you. A hybrid annuity is a term for retirement income products that allow long-term investors to split their funds between guaranteed rate and non-guaranteed rate. When you require long-term care, hybrid insurance policies allow you to access a portion of your life insurance death benefit or annuity value to cover care. Indexed annuities, also called equity-indexed or fixed-index annuities, are a hybrid. One type of indexed annuity, registered index-linked annuities (RILAs). A hybrid annuity combines the features of a fixed annuity and a variable annuity. Hybrid annuities offer guaranteed lifetime income like a fixed annuity. A hybrid annuity combines the stability of a fixed annuity with the potential for growth offered by a variable annuity. Hybrid Annuity. An industry coined term to describe a fixed indexed annuity that has an optional income rider attached. It enables people to invest in various assets, including stocks and bonds. Although this kind of annuity entails more risk, it also has the potential for more.

With a hybrid annuity, you can choose to invest your money in a variety of underlying investments, such as stocks, bonds, and mutual funds. The performance of. With a hybrid annuity, you allocate part of your annuity's assets to providing fixed income payments and part to making variable income payments. For example. Blended solution – this is a combination of separate retirement solutions. With the help of an adviser you might seek out the best annuity rate (see Annuities). The Hybrid Annuity Model (HAM) requires that part of the private sector financing by the concessionaire during the construction phase be. Hybrid annuities are a product combining the benefits of both guaranteed and non-guaranteed features. Hybrid annuities can have higher fees than other, simpler. Hybrid Annuity Model (HAM). Hybrid Annuity Model (HAM) is a model designed to revive PPP (Public Private Partnership) in highway construction. HAM is a mix. Some retirement funds are offering hybrid annuities as their default annuities, and may pay the annuity from your savings that remain in the fund after. A living annuity works like this: the retirement funds that you have not withdrawn as a cash lump sum are transferred to an investment that requires an annual. Hybrid Annuity — An insurance contract that allows buyers to allocate funds to both fixed and variable annuity components. Most hybrid annuities allow the. A hybrid annuity is a retirement income investment that allows investors to split their funds between fixed-rate and variable-rate components. Period certain. Hybrid Annuities protect better against longevity risk and when left in deferral typically produce a higher future income with **guarantees for the security of. Browse Terms By Number or Letter: A type of insurance company investment that combines the benefits of both a fixed annuity and a variable annuity. Aug. Hybrid Life/LTCi | Hybrid Annuity/LTCi | Policy Reviews | Life Settlements. (we recommend low-load permanent life insurance and annuities when possible). Exclusive Hybrid Annuities · Up to % of market gains annually** – with a legal guarantee* against market losses · Up to 7% guaranteed* annual roll-up rate. With an annuity long-term care hybrid product, you can virtually eliminate the need for a standalone LTC policy in your client's financial portfolio. Hybrid long-term care policies tend to be more expensive than traditional long-term care insurance or annuities because of the death benefit and investment. Hybrid: Whole Life and/or Annuities with LTC Benefits. Single, short, or continuos-pay asset-based Long Term Care funding solutions. We offer long-term care annuities from multiple insurance companies. Which LTC Annuity provider we suggest will depend on your age, health and policy size. SUBJECT: HYBRID ANNUITY MODEL FOR IMPLEMENTING HIGHWAY. PROJECTS-reg. The Competent Authority considered the above mentioned proposal of this Ministry on 27th.

Pulling The Equity Out Of Your Home

If you need to access additional funds, using the equity in your home can be a lower cost way to borrow the money compared to taking out a traditional loan or. You can figure out how much equity you have in your home by subtracting the amount you owe on all loans secured by your house from its appraised value. It's known as a Home Equity Line of Credit (HELOC). With a HELOC you borrow funds against the equity in your home on a need basis. Instead of taking out a full. Home equity is the portion of your home that you own, calculated as the difference between your property's market value and your outstanding mortgage balance. The handful of houses I got sub2 (short-hand version) were houses that were going to foreclosure, and the sellers were motivated to sell quickly. Sub2 is very. Getting funding through a home refinance involves updating your current home mortgage, adjusting the interest rates or terms of the loan and taking out cash at. When you are using the home to borrow money for whatever reason, that is “pulling equity” from your home. That means that you don't own the full. Also keep in mind that a home equity loan or line of credit decreases the amount of equity you have in your home. If you have taken out too much equity and the. Home equity loans allow homeowners to borrow against the equity in their homes. The loan amount is based on the difference between the home's current market. If you need to access additional funds, using the equity in your home can be a lower cost way to borrow the money compared to taking out a traditional loan or. You can figure out how much equity you have in your home by subtracting the amount you owe on all loans secured by your house from its appraised value. It's known as a Home Equity Line of Credit (HELOC). With a HELOC you borrow funds against the equity in your home on a need basis. Instead of taking out a full. Home equity is the portion of your home that you own, calculated as the difference between your property's market value and your outstanding mortgage balance. The handful of houses I got sub2 (short-hand version) were houses that were going to foreclosure, and the sellers were motivated to sell quickly. Sub2 is very. Getting funding through a home refinance involves updating your current home mortgage, adjusting the interest rates or terms of the loan and taking out cash at. When you are using the home to borrow money for whatever reason, that is “pulling equity” from your home. That means that you don't own the full. Also keep in mind that a home equity loan or line of credit decreases the amount of equity you have in your home. If you have taken out too much equity and the. Home equity loans allow homeowners to borrow against the equity in their homes. The loan amount is based on the difference between the home's current market.

There's Opportunity, But You Need To Weigh The Risks. The short version of this is that when done wisely, pulling out your equity can provide an opportunity to. Home equity loans, HELOCs, and reverse mortgages for elderly homeowners are also viable options for getting equity out of your house. In this case, you borrow more than is owed on the house. You might still owe $80, on the mortgage. But with a cash-out refinance you borrow $, The. There are three ways to leverage your home's equity: home equity loans, home equity lines of credit and a cash-out refinance loan. Yes, it is perfectly alright. Just make sure you are taking money out for the right reasons and don't need that money as you end your work life. With a HELOC, you're borrowing against the available equity in your home and the house is used as collateral for the line of credit. As you repay your. When you take equity out of your house, you are essentially borrowing against the portion of your home you own outright. This can provide you with a lump sum of. Take a look at these five alternatives to a cash-out refinance to see how they compare and find the solution that best suits your financial needs. The “equity'' figure in home equity loans is a simple math equation: Home's value minus amount owed = home equity. So, if your home is worth $, and you. With a HELOC, you can borrow against a portion of your total equity. Typically, lenders allow you to borrow a total combined amount of 75 to 90% of your home's. As long as you own 25% of your home, you can pull equity out of it. As for the speed of the application processes, it'll be different for every lender. You. Your home's equity is the difference between its market value and how much you still owe on your home. So as housing prices rise or you pay off your mortgage. When homeowners need extra cash, they often borrow against the equity in their home, known as home equity loans or lines of credit (HELOC). When you take equity out of your house, you are essentially borrowing against the portion of your home you own outright. This can provide you with a lump sum of. If you have substantial equity in your home, a cash-out refinance lets you pay off your current mortgage by refinancing it at a higher amount and taking the. A home equity loan, also known as a second mortgage, enables you as a homeowner to borrow money by leveraging the equity in your home. If you have substantial equity in your home, a cash-out refinance lets you pay off your current mortgage by refinancing it at a higher amount and taking the. If you fail to make your debt payments, you could lose your home to foreclosure. "This is the most significant risk associated with using home equity to pay off. Cash-out refinance pays off your existing first mortgage. This results in a new mortgage loan which may have different terms than your original loan. Apply now to consolidate your debts the smart way. Home Equity Line of Credit. Get the cash you need without leaving home. Apply with our % online.

T Rowe 2035

T. Rowe Price Retirement Fund · Fossil fuel finance · Commercial and investment banks' carbon-intensive funding is fundamentally incompatible with reaching. MassMutual Select T. Rowe Price Retirement Fund $MMTJX is % ($ MILLION) invested in gun manufacturer and major gun retailer stocks. The fund invests in a diversified portfolio of other T. Rowe Price stock and bond mutual funds that represent various asset classes and sectors. Its allocation. PARKX | A complete T Rowe Price Retirement Fund;Advisor mutual fund overview by MarketWatch. View mutual fund news, mutual fund market and mutual fund. Real time T. Rowe Price Retirement Funds, Inc. - T. Rowe Price Retirement Fund (TRRJX) stock price quote, stock graph, news & analysis. Get T. Rowe Price Retirement Fund Class R (RRTPX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. T. Rowe Price Retirement Fund TRFJX has $ BILLION invested in fossil fuels, % of the fund. T. Rowe Price Retirement Blend Fund · Price (USD) · Today's Change / % · 1 Year change+%. T. Rowe Price Retirement Fund Class R (05/07). RRTPX. BlackRock LifePath® Index Fund Investor A Shares. (05/11). T. Rowe Price Retirement Fund · Fossil fuel finance · Commercial and investment banks' carbon-intensive funding is fundamentally incompatible with reaching. MassMutual Select T. Rowe Price Retirement Fund $MMTJX is % ($ MILLION) invested in gun manufacturer and major gun retailer stocks. The fund invests in a diversified portfolio of other T. Rowe Price stock and bond mutual funds that represent various asset classes and sectors. Its allocation. PARKX | A complete T Rowe Price Retirement Fund;Advisor mutual fund overview by MarketWatch. View mutual fund news, mutual fund market and mutual fund. Real time T. Rowe Price Retirement Funds, Inc. - T. Rowe Price Retirement Fund (TRRJX) stock price quote, stock graph, news & analysis. Get T. Rowe Price Retirement Fund Class R (RRTPX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. T. Rowe Price Retirement Fund TRFJX has $ BILLION invested in fossil fuels, % of the fund. T. Rowe Price Retirement Blend Fund · Price (USD) · Today's Change / % · 1 Year change+%. T. Rowe Price Retirement Fund Class R (05/07). RRTPX. BlackRock LifePath® Index Fund Investor A Shares. (05/11).

MassMutual Select T. Rowe Price Retirement Fund $MMTLX is % ($ MILLION) invested in gun manufacturer and major gun retailer stocks. Get the latest T. Rowe Price Retirement Blend Fund (TBLYX) real-time quote, historical performance, charts, and other financial information to help you. Get the latest T. Rowe Price Retirement Fund Class R (RRTPX) real-time quote, historical performance, charts, and other financial information to help. The fund pursues its objective(s) by investing in a diversified portfolio of other T. Rowe Price stock and bond mutual funds that represent various asset. TRRJX Performance - Review the performance history of the T. Rowe Price Retirement fund to see it's current status, yearly returns, and dividend. T. Rowe Price Retirement Fund Advisor Class · Price (USD) · Today's Change / % · 1 Year change+%. TRRJX - T. Rowe Price Retirement Don't let mutual funds siphon away your returns. Get our FREE Report: "Index Funds and ETFs – A. T. ROWE PRICE RETIREMENT TRUST (CLASS A)- Performance charts including intraday, historical charts and prices and keydata. Find the latest performance data chart, historical data and news for Great Gray Trust T. Rowe Price Retirement Date Trust Fee Class R1 (WWTAQX) at. T. ROWE PRICE RETIREMENT TRUST (CLASS F)- Performance charts including intraday, historical charts and prices and keydata. Rowe Price Retirement (TRRJX) is an actively managed Allocation Target-Date fund. T. Rowe Price launched the fund in The investment seeks the. Page 1. Release Date: T Rowe Price Retirement Advisor Class. Available in Portfolio Director® Fixed and Variable Annuity. T. Rowe Price Retirement Fund ; 1. Imperial Brands PLC. % of portfolio. $M invested ; 2. Philip Morris International Inc. % of portfolio. $M. Complete T Rowe Price Retirement Fund funds overview by Barron's. View the TRRJX funds market news. View the latest T Rowe Price Retirement Fund (TRRJX) stock price, news, historical charts, analyst ratings and financial information from WSJ. T. Rowe Price Retirement Fund Military weapon grade: Fund is invested in military contractors above the threshold of % and below the threshold of 4%. T Rowe Price Retirement Fund seeks total return return over time consistent with an emphasis on both capital growth and income. The Fund invests in a. Get RRTPX mutual fund information for T.-Rowe-Price-RetirementFund-Class-R, including a fund overview,, Morningstar summary, tax analysis. The fund pursues its objective(s) by investing in a diversified portfolio of other T. Rowe Price stock and bond mutual funds that represent various asset. MassMutual Select T. Rowe Price Retirement Fund Deforestation grade: Fund is invested in deforestation-risk agricultural commodity producer/traders.

How To Finance A Home Remodel Without Equity

A no-equity home repair loan can be used for a variety of purposes, from making small repairs to financing major renovations. This can be a great option if you. When financing such large projects, be it a new kitchen or an upgraded basement-turned-schoolroom, you usually have the option to pay cash, finance the costs. If you don't any equity, you could consider getting an unsecured home improvement loan instead, as this doesn't require any assets. One of the most common types of home equity loans is a home equity line of credit (HELOC). A HELOC allows you to borrow money against your home's equity, and. The most typical loans include Home Equity Loans, HELOCs (Home Equity Lines of Credit) and Mortgage refinances. Government Loans such as a HUD Title 1 Property. You can finance a home renovation with cash-out mortgage refinancing, a home equity loan or line of credit, a personal loan, a Fannie Mae HomeStyle Renovation. Home improvement loans allow homeowners to finance home improvement projects without using their homes as collateral. However, because this type of loan is not. Many homeowners use their equity to pay for home improvements, repairs, and additions, however, what if you do not have any equity built up in your home? If you want to finance home improvements but have little or no home equity, FHA can help. FHA (k) or Title 1 loans can help you finance home improvements. A no-equity home repair loan can be used for a variety of purposes, from making small repairs to financing major renovations. This can be a great option if you. When financing such large projects, be it a new kitchen or an upgraded basement-turned-schoolroom, you usually have the option to pay cash, finance the costs. If you don't any equity, you could consider getting an unsecured home improvement loan instead, as this doesn't require any assets. One of the most common types of home equity loans is a home equity line of credit (HELOC). A HELOC allows you to borrow money against your home's equity, and. The most typical loans include Home Equity Loans, HELOCs (Home Equity Lines of Credit) and Mortgage refinances. Government Loans such as a HUD Title 1 Property. You can finance a home renovation with cash-out mortgage refinancing, a home equity loan or line of credit, a personal loan, a Fannie Mae HomeStyle Renovation. Home improvement loans allow homeowners to finance home improvement projects without using their homes as collateral. However, because this type of loan is not. Many homeowners use their equity to pay for home improvements, repairs, and additions, however, what if you do not have any equity built up in your home? If you want to finance home improvements but have little or no home equity, FHA can help. FHA (k) or Title 1 loans can help you finance home improvements.

1. Take out a home equity loan. · 2. Refinance your home. · 3. Get a future-value construction loan. 1. Personal Loan · 2. Home Equity Line of Credit (HELOC) · 3. Home Equity Loans · 4. Cash-Out Refinance · 5. 0% APR Credit Cards · 6. HUD Title 1 Property. Evaluate home improvement financing options · A home equity loan is often called a second mortgage. · A home equity line of credit (HELOC) works similarly to a. You can open a HELOC, or a Home Equity Line Of Credit, which is an open credit line that's secured by your home's value for up to 10 years. Is there any way to get a loan (without making a terrible financial decision to do ao) to do some of the repairs and updating? Luckily, there are some options that enable you to make those desired improvements on your home, including a Cash-Out Refinance and a Home Equity Line of Credit. Robert Haley (RH): Two common methods are a home equity installment loan (HEIL), more commonly known as an HE loan, or a home equity line of credit (HELOC). Property Improvement Loan will pay for materials and labor. · Get more than one estimate. Remember the cheapest one isn't always the best fit. · Read and. Low rates. Great service. That's Lending Uncomplicated. Whole-project funding, with no fees, no home equity requirements. The unsecured LightStream loan has. If your home needs a little TLC but you don't have substantial equity in your home yet, then a "No Equity" Home Improvement Loan could be right for you. With a. Home equity is the perfect place to turn to for funding a home remodeling or home improvement project. It makes sense to use your home's value to borrow money. A no-equity home repair loan can be used for a variety of purposes, from making small repairs to financing major renovations. This can be a great option if you. A home equity line of credit (HELOC) is commonly used to help pay for a home renovation. See when it makes sense to borrow against your home equity and when it. Both HELOCs and home equity loans can be great options for financing a remodel. Ultimately, it will come down to your individual needs and preferences, as both. Acorn Finance can help you discover lenders that can help you without affecting your credit score. Which banks & lenders are good options for home improvement. Our online process makes it easy to apply for a home renovation loan. Fix a leaky roof, remodel your kitchen, or update your backyard—we're here to help. 1 Home Remodel Financing · 2 Home Equity Line of Credit (HELOC) · 3 Home Equity Loan · 4 Cash-Out Refinance · 5 Renovation Loan · 6 Construction Loan · 7 FHA & Fannie. The Home Improvement Loan Program is a membership benefit offered by the Northwest Home Equity Assurance Program. Unlike a HELOC, a home equity loan is given as a lump sum of money. It is a percentage of your home equity with a fixed interest rate, but there is no draw. Don't be limited by the amount of equity in your home. With an unsecured home improvement loan, borrow funds without using your home as collateral. Check my.

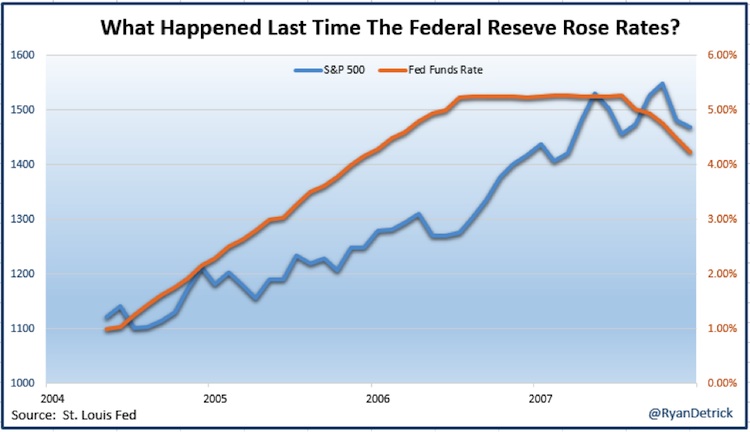

Stocks For Rising Interest Rates

Data from May 31, to May 31, REITs, Stocks, Bonds, and Commodities are represented by the Dow Jones U.S. Select REIT Index, the S&P ®, Barclays. That is, when interest rates are lower, equity valuations could, or even should, be higher. We saw this play out in the late s, as interest rates fell and. Generally, interest rates and the stock market have an inverse relationship. When interest rates rise, share prices fall. Bonds become more attractive. Consumer Discretionary, Industrials, and Materials stocks tend to underperform during rate-hike cycles as investors anticipate that higher inflation and. financial, industrials and infrastructure stocks will get hit the most by rising interest rates. Financial stock will suffer due to margin. Generally, interest rates and the stock market have an inverse relationship. When interest rates rise, share prices fall. Bonds become more attractive. An increase in interest rates can cause stocks that have bond-like characteristics (significant, regular dividend payouts and stable prices) such as preferred. high cash yields plus alpha while maintaining low correlations to stocks High interest rates and yields, artificial intelligence, and elevated stock. Simply Wall St analyst Bailey Pemberton and Simply Wall St have no position in any of the companies mentioned. View all stocks in the US market. Data from May 31, to May 31, REITs, Stocks, Bonds, and Commodities are represented by the Dow Jones U.S. Select REIT Index, the S&P ®, Barclays. That is, when interest rates are lower, equity valuations could, or even should, be higher. We saw this play out in the late s, as interest rates fell and. Generally, interest rates and the stock market have an inverse relationship. When interest rates rise, share prices fall. Bonds become more attractive. Consumer Discretionary, Industrials, and Materials stocks tend to underperform during rate-hike cycles as investors anticipate that higher inflation and. financial, industrials and infrastructure stocks will get hit the most by rising interest rates. Financial stock will suffer due to margin. Generally, interest rates and the stock market have an inverse relationship. When interest rates rise, share prices fall. Bonds become more attractive. An increase in interest rates can cause stocks that have bond-like characteristics (significant, regular dividend payouts and stable prices) such as preferred. high cash yields plus alpha while maintaining low correlations to stocks High interest rates and yields, artificial intelligence, and elevated stock. Simply Wall St analyst Bailey Pemberton and Simply Wall St have no position in any of the companies mentioned. View all stocks in the US market.

high cash yields plus alpha while maintaining low correlations to stocks High interest rates and yields, artificial intelligence, and elevated stock. What stocks are likely to rise/fall due to the interest rate hikes? What would the best way to benefit off the rate hike be? I have about ~. As we approach the first anniversary of the last Fed rate hike for this cycle (July ), the S&P is higher by roughly +20% on a total return basis since. Interest rates are rising sharply. Higher interest rates are one tool When interest rates increase, this negatively affects the performance of stocks. If you have seen an advertisement about our report, 'Rising Interest Rates', you can find that information below: If you are a member of. Higher interest rates and inflation may favor international investing going forward Low interest rates and low inflation favored growth stocks for. Although interest rates are expected to continue to rise in the near future, many economists expect these increases to be gradual, creating a slow rate increase. That is, when interest rates are lower, equity valuations could, or even should, be higher. We saw this play out in the late s, as interest rates fell and. In general, lower interest rates lead to higher stock prices while higher rates tend to lead to falling stock prices. · Interest rates are normally set by. OVERVIEW. Interest rates rose dramatically in , causing an abrupt shift in banking conditions. The increase in the federal funds target rate. 1. US stocks · 2. Small caps · 3. Interest-rate-sensitive sectors · 4. Investment-grade corporate bonds · 5. US Treasurys. Although interest rates are expected to continue to rise in the near future, many economists expect these increases to be gradual, creating a slow rate increase. Historically, stocks and bonds have performed well when interest rates were above 4%. Stocks in the consumer discretionary, industrials, and materials sectors tend to underperform in the year following the start of a new rate-hike cycle as. Stocks to Watch When Rates Rise ; Bank of America, BAC, Financial (Banking) ; JPMorgan Chase, JPM, Financial (Banking) ; Goldman Sachs, GS, Financial (Investment. When interest rates rise, the discount rate may increase, which in turn could cause the price of the stock to fall. However, it is also possible that when. An increase in interest rates can cause stocks that have bond-like characteristics (significant, regular dividend payouts and stable prices) such as preferred. When interest rates rise, the discount rate may increase, which in turn could cause the price of the stock to fall. However, it is also possible that when. Historically, stocks and bonds have performed well when interest rates were above 4%. As a result, this month I'm focusing on the past relationship between high interest rates, economic growth, and returns in the stock and bond markets. Rates.

1 2 3 4 5 6